Montgomery County’s Office of Internal Audit (MCIA) is housed under the ‘Office of the County Executive’ and states that its program:

“…provides independent strategic risk-based auditing services. The core function of this program is to improve internal controls and provide reasonable assurance of reliable financial reporting, effective and efficient operations, legal and regulatory compliance, fraud investigation and deterrence, and the safeguarding of County assets.”

In a nutshell: this is an internal watchdog responsible for evaluating, independently, how MoCo government’s resources (aka the people’s resources) and departments are being utilized. The internal auditor reports provide feedback on the effectiveness of safeguards against negative risks of all kinds (financial, legal, operational, etc). This is all the more important in 2023 because of County Executive Marc Elrich’s spending addiction and continued desire to simply throw money or people’s time at whatever political cause célèbre arises nationally for his political party.

We have detailed some of the prior waste of “American Rescue Plan Act” funds here.

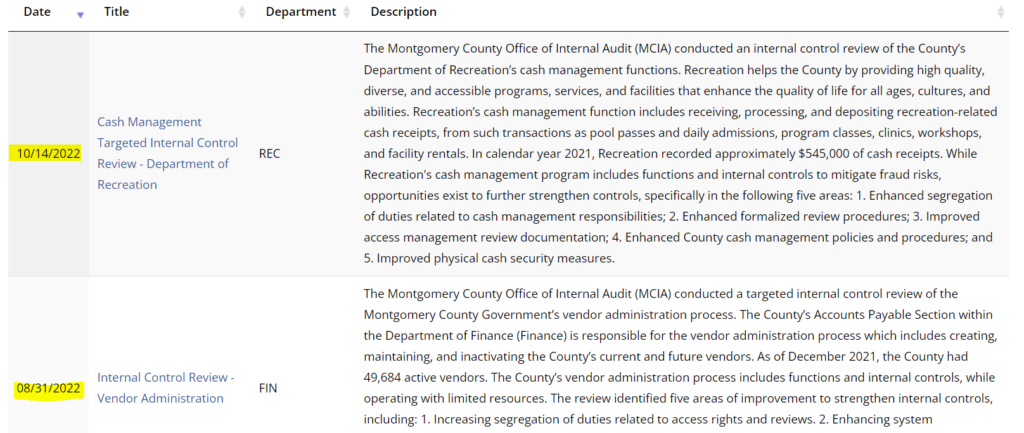

MCIA does provide a public-facing database of its prior reports for us all to review. A screen shot below captures the most recent reports issued.

It has now been seven-plus months since the last review/report, of the MoCo Recreation Department’s Cash Management Internal Controls, was issued. In 2022, per this database and the dates provided, at least six reports were issued by MCIA on various functions and County government departments. In 2023, nearly six months into the year, not a single new internal audit report has been issued. Is the watchdog asleep?

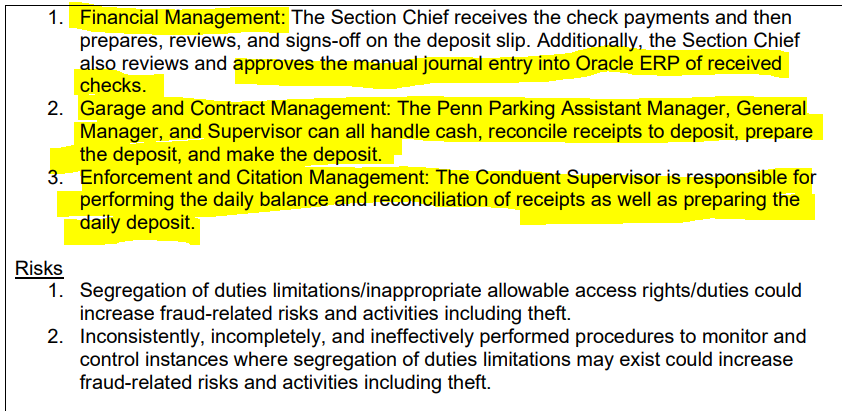

Interestingly, diving briefly into both the October 2022 report on the cash management at the Department of Recreation and the August 2022 report on the cash management practices and controls at the MoCo Department of Transportation, a similar theme arises. Montgomery County departments have very lax segregation of responsibilities when it comes to cash handling, recording that cash and then reconciling the records to a bank statement. This is a common cash issue for a small business, which generally only has two or three employees with which to carry out some of these functions.

For a multi-billion dollar County government with many employees, however? The following (below, taken direct from page nine of this report) are some pretty brazen loopholes / openings for fraud and quick theft of what should be county dollars.

According to this same report, back in fiscal year 2020, total cash managed by ‘Garage and Contract Management’ alone totaled $993,478. That is just what was reported. How much might have been taken “on the side” due to lax cash management controls?

More to come.