The Montgomery County Council invited submissions of testimony related to the FY24 Budget on April 13, 2023. One resident, Louis Wilen, submitted testimony and supporting documents that make a strong case for the County to recover over $100 million in improperly issued Income Tax Offset Credits (ITOC).

Mr. Wilen is no stranger to identifying fiscal improprieties. In 2021, and as reported here, work done by Mr. Wilen led to issuance of refunds of $11 million by the State of Maryland to homeowners. In addition, Mr. Wilen’s work spurred Montgomery County to refund over $4 million of improperly collected property tax to senior citizens in Montgomery County. And back in 2005, state legislators used work by Mr. Wilen to support passage of the Homestead Credit Verification Act, which has stopped an untold amount of Homestead Credit tax credit leakage over the years.

Louis Wilen of Olney discovered in 2016 that the State Department of Assessments and Taxation, or SDAT, was deducting other tax credits from the HTC. For four years, he sounded the alarm.

Now his work has paid off, literally, for thousands of people.

Louis Wilen is now sounding the alarm, and this time directly to the Montgomery County Council.

A bit of background:

In 2022 the County issued the $692 ITOC credit presumptively on the 2022 tax bills with a plan to claw it back from homeowners who do not submit their Homestead Tax Credit (HTC) application by May 1, 2023. There was no legal basis to do this, and the County is currently planning to allow property owners to keep the presumptively issued credits even when a homeowner submitted his homestead credit application after the May 1, 2022 statutory deadline even though doing so violates state law.

To give it full justice, here is the testimony submitted by Mr. Wilen:

Good afternoon Mr. President and members of the County Council, I’m here to address the Council budget discussion that took place a few days ago about the $692 ITOC. During the discussion, the issue of including the clawed-back ITOC funds in the proposed budget was raised. One concern was that including the clawed-back ITOC funds in the 2023 budget would cause fiscal distortions that would impact spending in the future.

To clarify, the county issued the $692 credit presumptively on the 2022 tax bills with a plan to claw it back from homeowners who do not submit their Homestead Tax Credit (HTC) application by May 1, 2023. However, the statutory deadline for submitting the HTC application to qualify for the ITOC in 2022 was actually May 1, 2022 and there is no legal

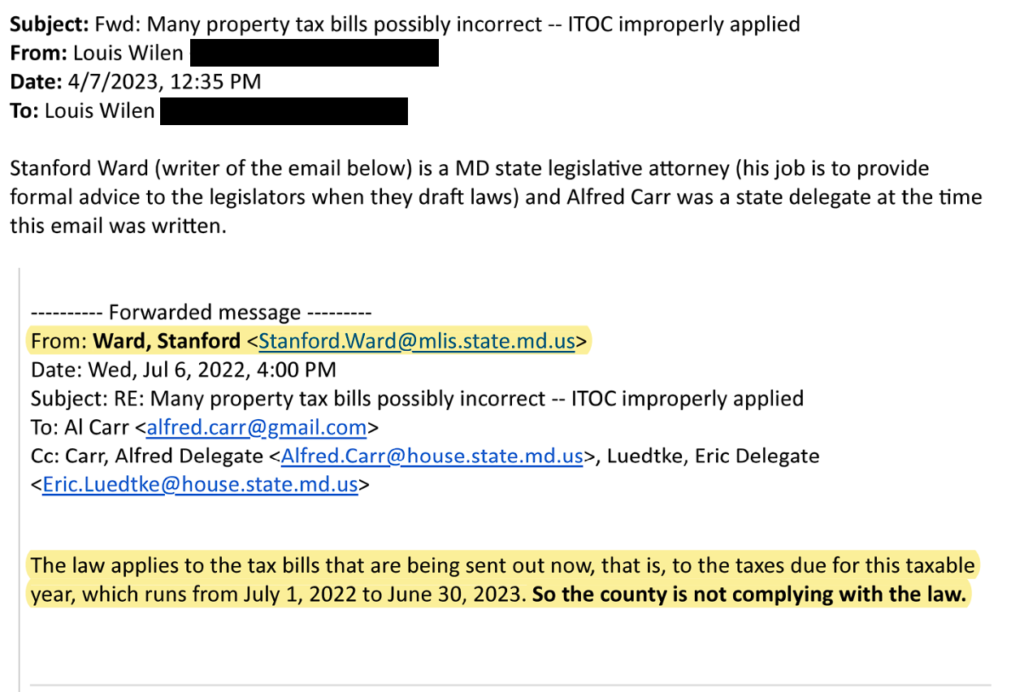

basis for presumptively issuing the ITOC.Therefore, the county should be clawing back all of the $692 ITOCs awarded in 2022 to homeowners who had not submitted their HTC applications by May 1, 2022. Former Delegate Eric Luedtke (now the governor’s Chief Legislative Officer) sponsored the bill (HB1200 of 2020) that ties issuance of the ITOC to having an approved HTC form on file at SDAT. In 2022, Mr. Luedtke confirmed in writing to the county finance director that state law does not allow for presumptive issuance of the ITOC. Stanford Ward, legislative attorney to the General Assembly, also confirmed in writing in 2022 that “the county is not complying with the [state] law” by presumptively issuing the ITOC.

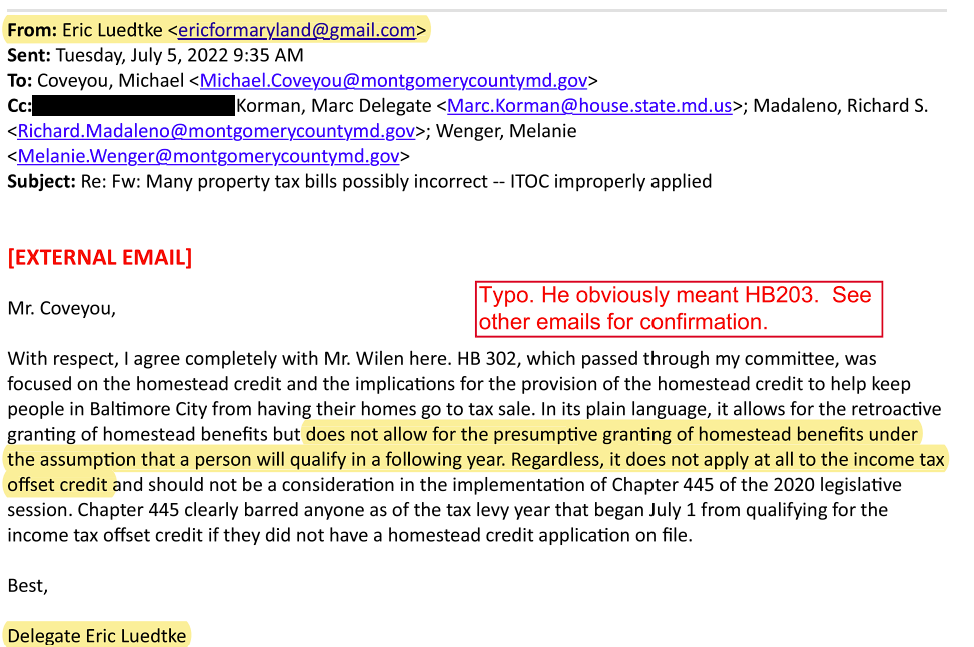

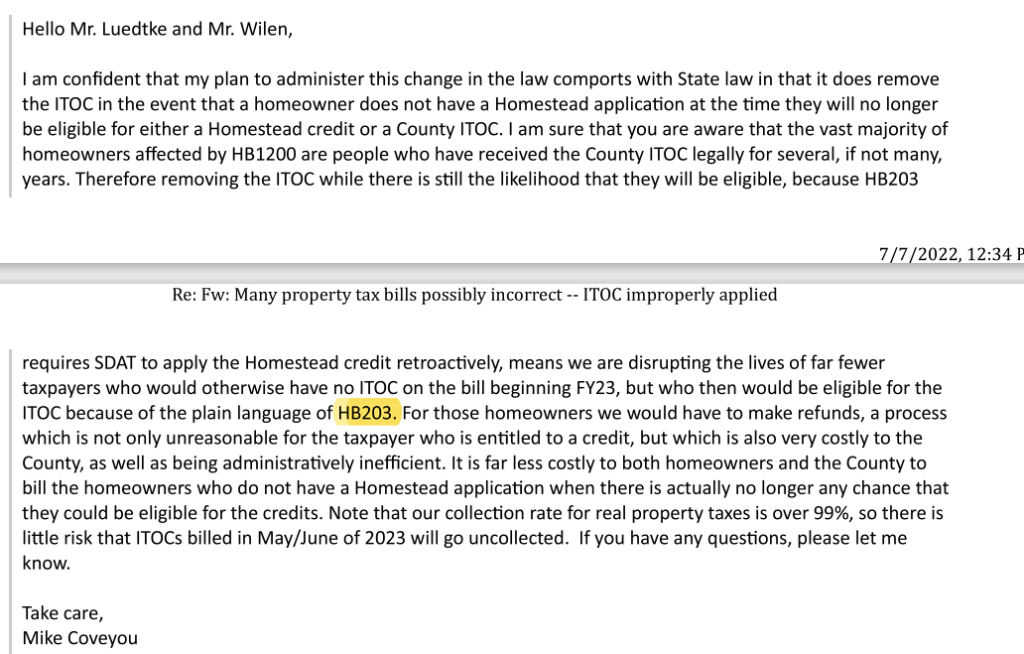

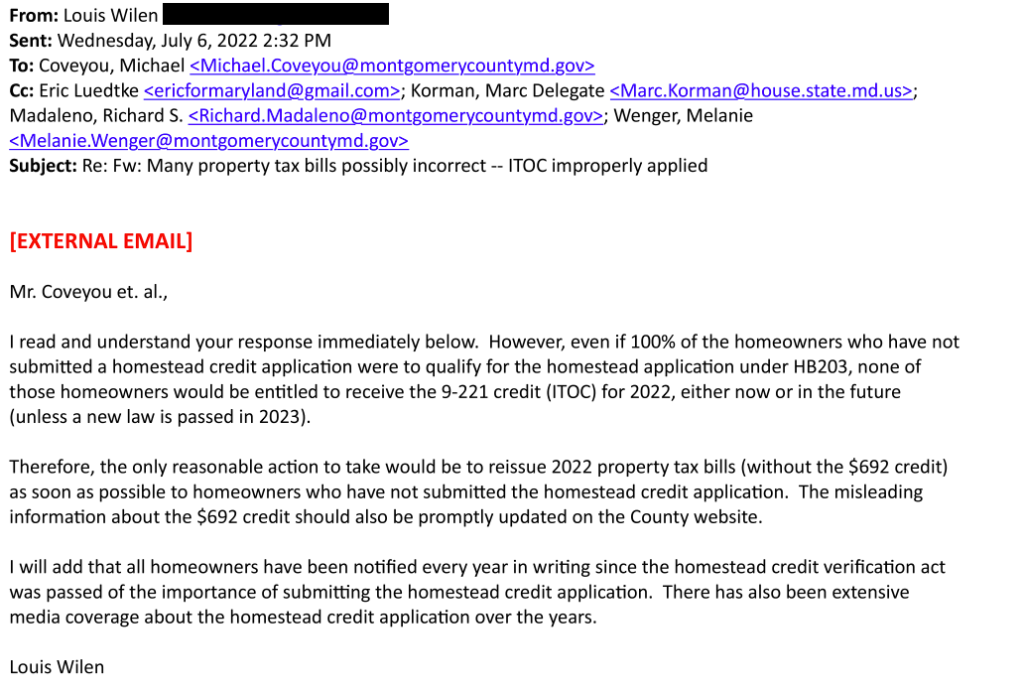

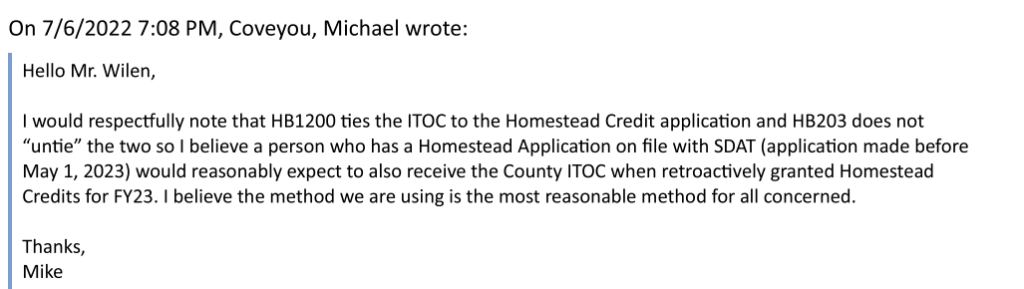

The relevant emails sent by Mr. Luedtke and Mr. Ward to the finance director and to state delegates are included with my written testimony. (presented as screen shots below)

The county attorney has reportedly claimed that another enacted bill, HB203 of 2022, allows presumptive issuance of the ITOC. Former Delegate Luedtke quashed the claim, writing that “HB203 passed through my committee,” and he “entirely agrees with Mr. Wilen.” Again, see the attached emails. (presented as screen shots below)

By following state law, the budget concerns involving the ITOC problems can be resolved and the county will recover many millions of dollars of improperly issued tax credits. Also, you could reduce the 2023 tax rate or increase the 2023 ITOC by clawing back the improperly awarded 2022 ITOCs.

Thank you for allowing me to speak.

Here are the emails referenced in the testimony. You can see that Mr. Wilen is raising the issue and then chasing down answers as you follow the chain.

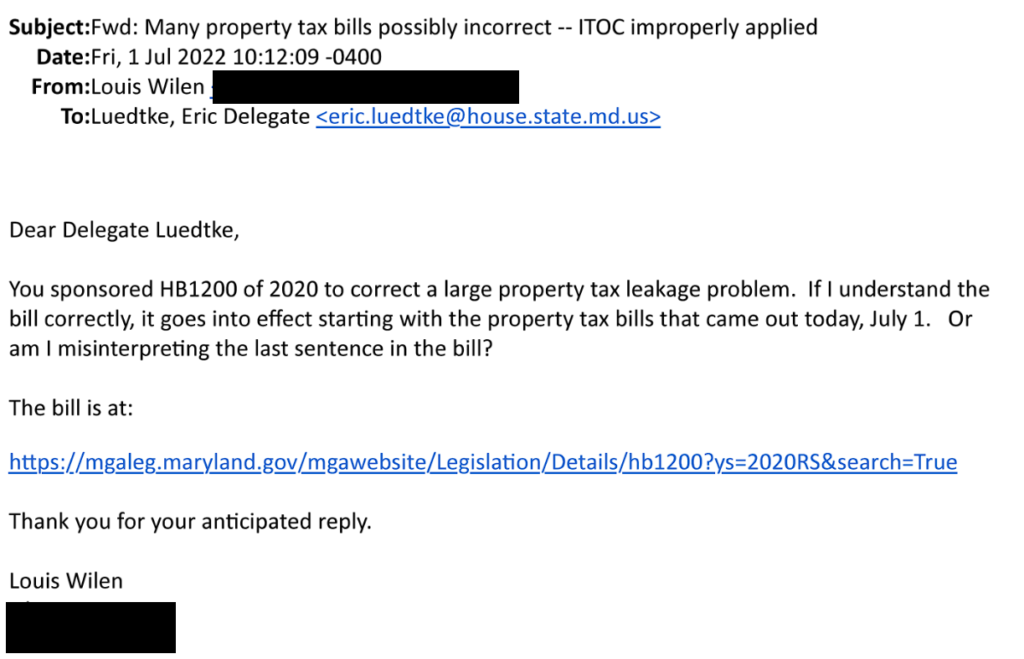

Mr. Wilen reaches out to Delegate Luedtke:

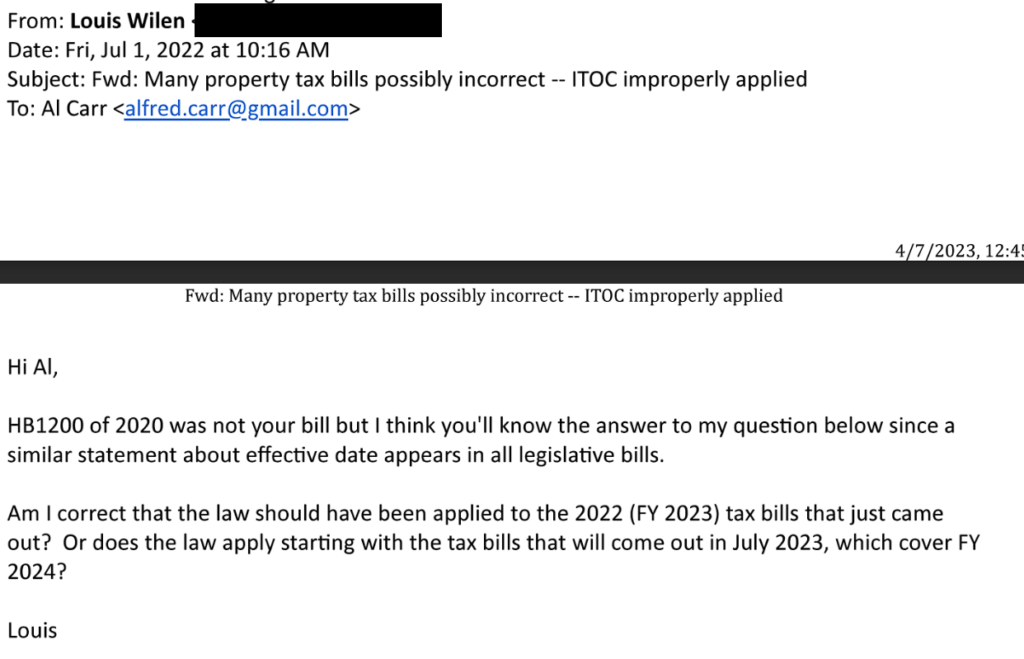

Mr. Wilen on the same day also reaches out to Delegate Al Carr:

There is no response from Delegate Luedtke, but Delegate Carr does provide an answer to Mr. Wilson’s question:

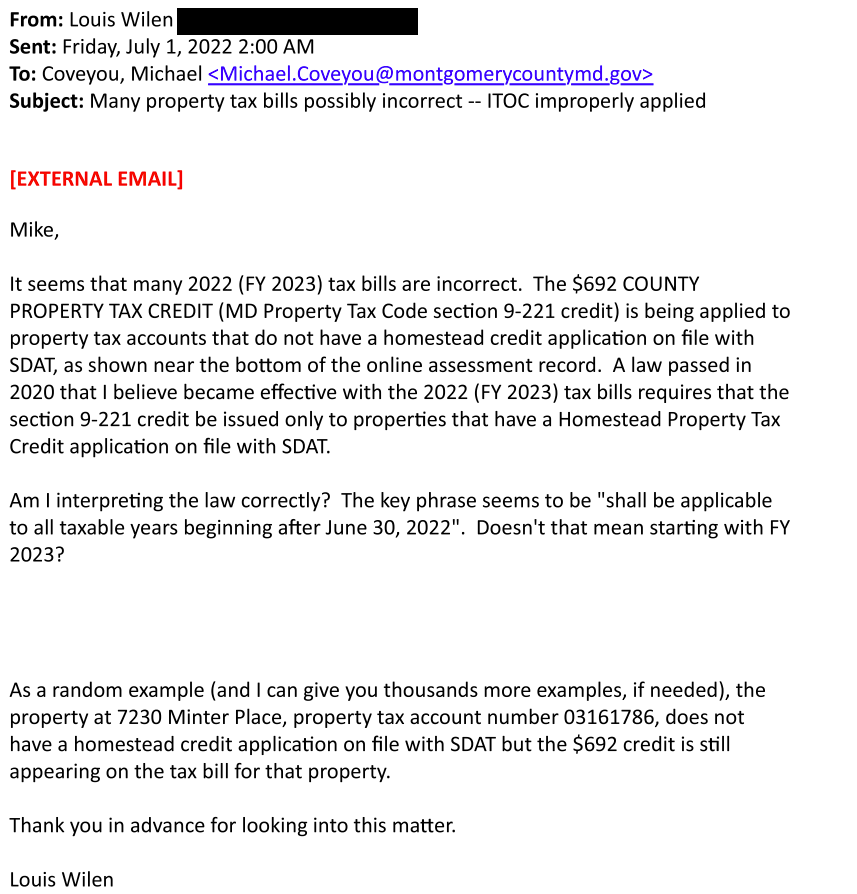

With the information not being confirmed that the County is not complying with the law, Mr. Wilen raises the issues with Montgomery County’s Director of Finance Mr. Coveyou:

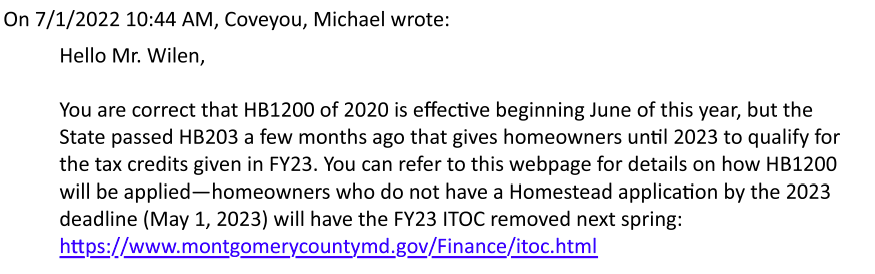

Mr. Coveyou replies:

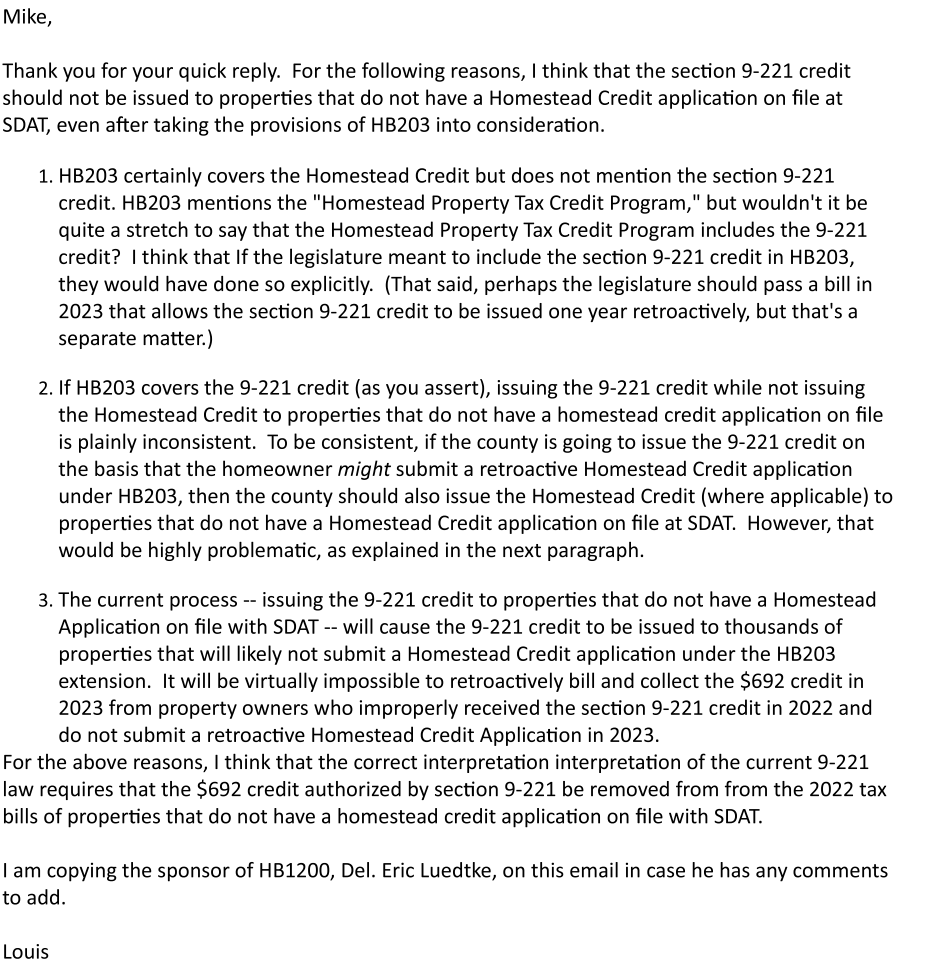

Mr. Wilen replies and again loops in Delegate Luedtke:

Mr. Wilen and Mr. Coveyou have a back and forth correspondence.

Delegate Luedtke finally chimes in:

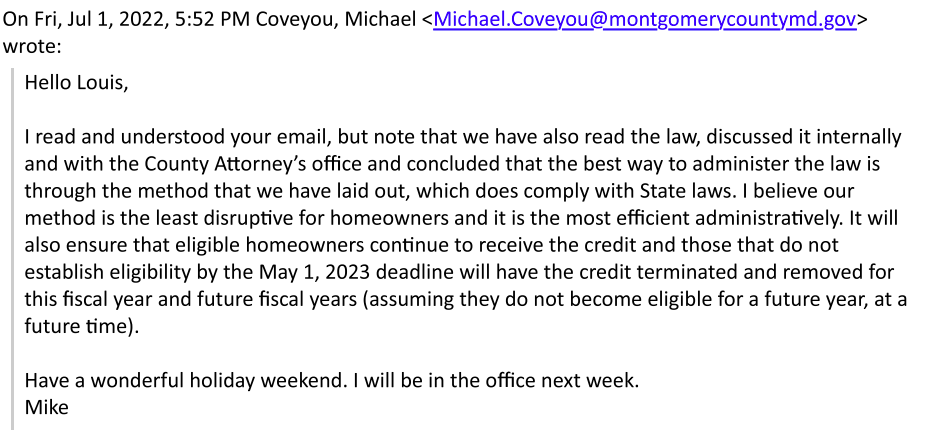

Mr. Coveyou disagrees and believes the County is on firm footing:

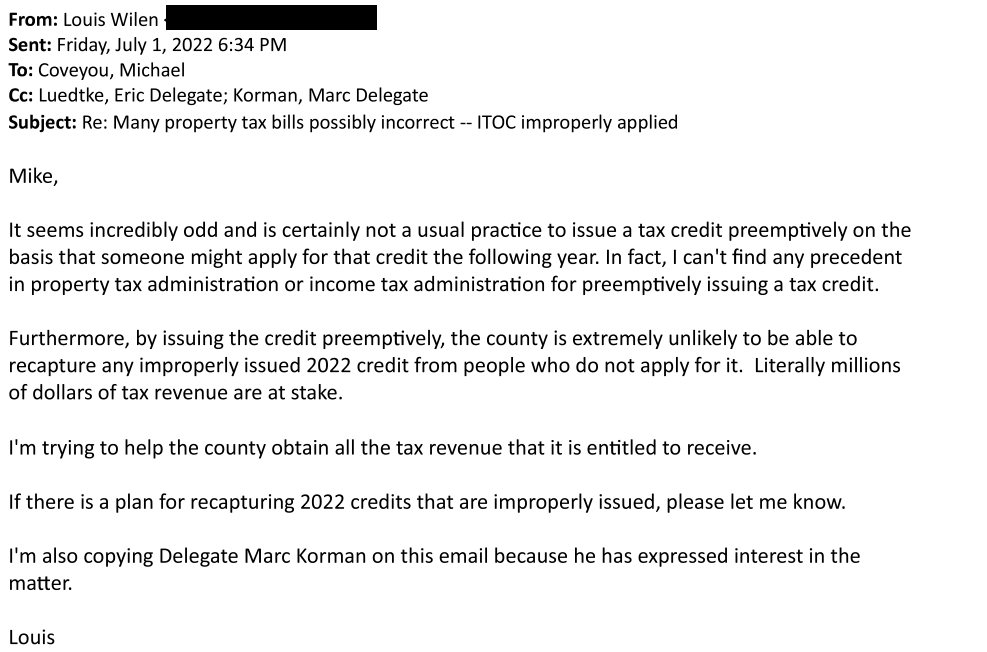

Again, more back and forth between Mr. Wilen and Mr. Coveyou.

You might find it ridiculous that residents need to apply for a Homestead Credit to receive a tax credit, but that is beside the point in this situation. The point is, is the County abiding by current State laws, and if not, what is motivating their decision?

These questions deserve to be answered as the county debates the proposed budget.

*All material published by consent of Mr. Louis Wilen