In yet another blow to fiscal stewardship of the taxpayer dollar in Montgomery County, data from the MoCo “Checkbook” in 2023 reveals that Montgomery County’s “Economic Development Fund” gave a nonprofit corporation called Life Asset Inc. a $50,000 check in May, 2023. See our screen shot below:

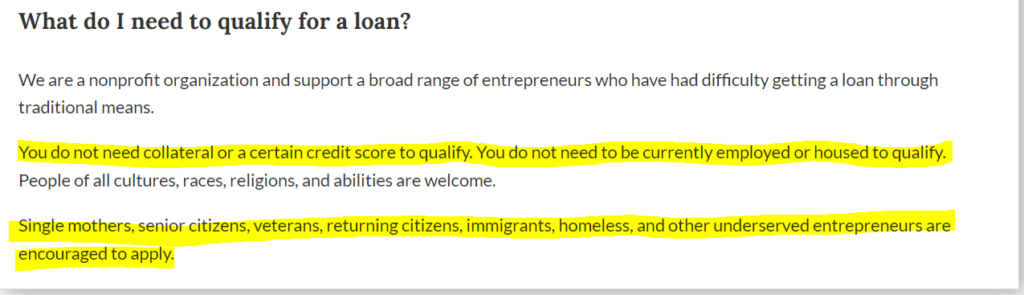

Life Asset Inc. says it is a “nonprofit organization” that supports a broad range of entrepreneurs “who have had difficulty getting a loan through traditional means.” With credit / interest rates being insanely (and artificially) cheap and abundant these past few years, post-covid pandemic, who exactly is Life Asset Inc targeting with this message?

Below is a direct screenshot from Life Asset’s website:

So… it appears that Life Asset Inc provides “micro-loans” to individuals with no credit score, no employment, no fixed address, no immigration status – and no collateral needed. Is this basically strings-free “UBI” by just a different name? Did CM Will Jawando think up this “business model”?

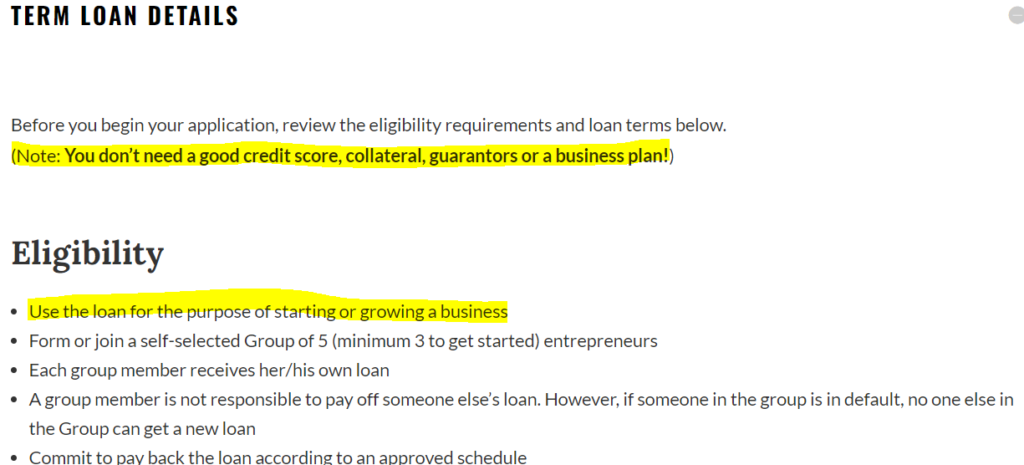

It appears you don’t even need a business plan to apply for a “micro-loan”:

Life Asset Inc. says on its website that is was founded in 2011, and that its micro-lending program was “developed in direct response to the unmet need for financial services for low-income individuals. Since then, we have remained committed to providing microloans and training to low-income entrepreneurs who are overlooked by traditional lenders and financial institutions.”

Sure reads well. And giving people a hands up is very commendable, especially in high-cost MoCo, where things are artificially increased because of the politicians’ choices. Life Asset Inc may well be a worthy nonprofit corporation for individuals to voluntarily donate their money or time to.

But that is the key word. Voluntary. Taxpayer dollars ($50,000 in this case, more in the case of Jawando’s so-called UBI trial program) shouldn’t be granted to a “lender” that lends money with such non-existent requirements on borrowers. That is madness. If you came in front of the MoCo Council or the MoCo Economic Development Corporation and asked for $50,000 with no business plan, revenues, address, employees or even collateral… what would these people say to you? What would any bank say to such a request?

MoCo taxpayers deserve to have each zinc penny accounted for — not flushed through something like this.

More to come.