The following is a counterpoint to the article entitled, Are Taxpayer Investments in Biotech Companies Too Risky?, published on March 6 2023.

Life Science investing is risky. We should scrutinize the wisdom of any public investment into private ventures. And, our elected leaders, if they don’t have experience in this or other areas, should be well counseled by staff or folks with requisite expertise on the items they will vote on. On these points, the Author and I agree.

However, while the Author highlights risks and legitimate concerns surrounding investments in Life Sciences, they omit the other side of the ledger. That is, listing any of the benefits or realities associated with Life Sciences and the nature of economic Incentives. A few examples:

- Great Paying Jobs – As of their last disclosure (2022), Novavax reported employing close to 2,000 people. The bulk of which are in Montgomery County. Life Science jobs are one of the best paying. In the state of Maryland, median personal wages are ~$69K, while median Life Science personal wages are ~$82K. That’s a sizeable difference! Each and every one of those Life Science employees contributes to the economic vitality of MoCo. And these jobs benefit a wide cross-section of Marylanders, not just those with PhDs, MDs, PharmDs, or MBAs. In MoCo, Montgomery College has great programs to help folks get into the Life Sciences or transition into After successful completion, these programs have a nearly 100% job placement track record.

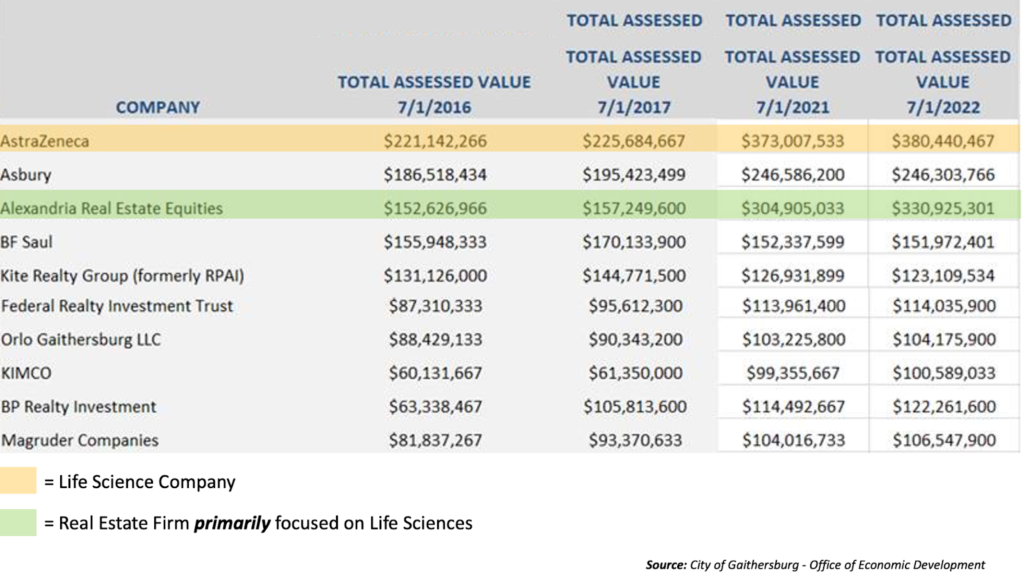

- Strong Tax Base – Our largest property taxpayers are in the Life Sciences. Either directly like Astra Zeneca or indirectly through Real Estate Firms that specialize in the Life Sciences (e.g., Alexandria Realty). Here is a snapshot of data in the city of Gaithersburg. The impact is even greater when you consider the rest of MoCo.

- Competing Jurisdictions – Jurisdictions within Maryland and externally (e.g., Boston, NC, CA, VA, etc.) heavily compete for and have a bevy of incentives for Life Science companies. If we do not have a local and thoughtful approach to incentives, we run the risk of losing this vital employment base.

- Taxpayer Protections: Incentives are not without conditions. There are clawbacks, employment minimums, loan repayments, and other conditions that governments deploy to make sure taxpayers are getting a fair deal for their investment.

- Portfolio Approach: Some Life Science firms will fail. That is expected and part of the business cycle. When considering the County’s or City’s tolerance to this exposure, ask yourself what percentage of the overall budget will be put at risk. And what type of risk exposure is being pursued. A startup biotech company with zero revenues is a much riskier investment than a company with marketed products. That is why the incentive packages are tailored for specific stages of development. Incentives are allocated after weighing the risk, reward, and related factors. Additionally, as a percentage of the total budget, financial exposure is quite modest. Take Gaithersburg, for example, a toolbox grant of $50,000 an operating budget of $72.5 million Personally, I would advocate for more investment in the Life Sciences so we can further expand our core employment base.

- Ecosystem / Anchors: When early-stage companies are created in MoCo, and over the course of time, transition into commercial-stage companies, they are “stickier” in the area and provide a longer-term anchor of jobs. Case in point, MedImmune (now AZ), is still here, employing lots of folks. In my opinion, it is much harder to move the headquarters of established companies into MoCo, than to foster an ecosystem that creates them. So far, MoCo has not been able to land a new HQ migration but has been able to foster the creation of new companies (albeit at a slower rate than we would all want).

Near the end of the post, the Author writes:

“[D]oes County government need to consistently throw millions of the people’s money at very risky enterprises, particularly in the “life sciences” / biotechnology industry?”

My answer is a resounding YES! That doesn’t mean we should invest these dollars willy-nilly or haphazardly. Care, diligence, and effort should be exercised, and competent stakeholders should be involved in the decision-making. Properly executed, these incentives produce a great return not only in economic terms (e.g., higher paying jobs, broader tax base, economic development, etc.) but in life value, delivering new therapies and innovations that significantly improve our quality of life in ways no other industry can.

Yamil Hernández is the Co-Founder and Chief Business Officer of ExeGi Pharma.