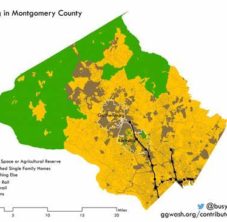

Anyone who cares about affordable housing supports rezoning—including President Biden’s administration and more recently the Senate’s bi-partisan ROAD to Housing Act. For my part, I’ve written dozens of articles in favor of blanket rezoning the acres upon acres of single-family lots throughout Montgomery County to increase the supply and lower the price. Unfortunately, recent experience is showing us that rezoning seems to make housing even less affordable.

In the DMV region, Ground Zero for rezoning is Arlington. Reformers there were able to get the entire county rezoned away from single-family parcels. The results have been extremely frustrating.

The above video (timestamp 1:45) describes a duplex going up on North Troy St in Arlington. Each unit of the duplex is offered at $1,795,000 while an existing nearby single-family home was sold for $862,500. Not only does this new construction betray the promise of affordable housing, it is making that neighborhood even more exclusive. A reader told me the same pattern occurs in Bethesda’s Westbard district.

First of all, comparing the cost of a 50 year-old-home to that of a new duplex is hardly fair. My 50-year-old home suffers from old plumbing, shaky wiring, cracked foundation, and all the other features of deferred maintenance. New construction is invariably of higher quality than time-worn construction. Regardless, how can a new duplex be so much more expensive than an existing single-family home? Let’s go through a costing exercise.

Suppose we want to demolish a single-family home and put up a duplex. First, we need to purchase the lot along with the existing house. At a purchase price of $862,500, approximately $690,000 (80%) is allocated to the demolished structure and is literally thrown into the garbage. Let’s allocate one-half of that purchase price ($431,250) to each unit in the duplex.

Each duplex will have 2,470 square feet. At $400/square foot, the estimated cost of construction is $988,000. ְAdd on $30,000 for architects, demolition, and permits, and the cost of the duplex is now $1,449,250.

If we finance the entire project at 7½% over 18 months, the interest is approximately $78,022, and the cost of each duplex is now $1,527,272. If the unit indeed sells for $1,795,000, our profit is $267,727 or 15% over 18 months. Annualized, this return is 9.8%.

An annualized pre-tax return of 9.8% on construction projects is not excessive.

This exercise leaves us with the realization that, for at least the next 5–10 years, redeveloping a single-family lot into a duplex will indeed deliver units costing more than the demolished home. This realization is local confirmation to what affordable-housing developer Patrick McAnaney wrote in Why no one’s building middle-income housing in American cities.

Because demolishing the existing structure is such a high component of a new duplex’s cost, delivery of affordable housing is much more likely on large parking lots or in subdivisions where the existing structure takes up a small percentage of the lot.

Regardless, does this reality justify maintaining restrictive zoning laws? Part 2 of this series addresses this question.

[Lead image: New duplex going up in Arlington. Source: MISSING MIDDLE HOUSING’s MYTH of AFFORDABILITY in Arlington, Virginia]